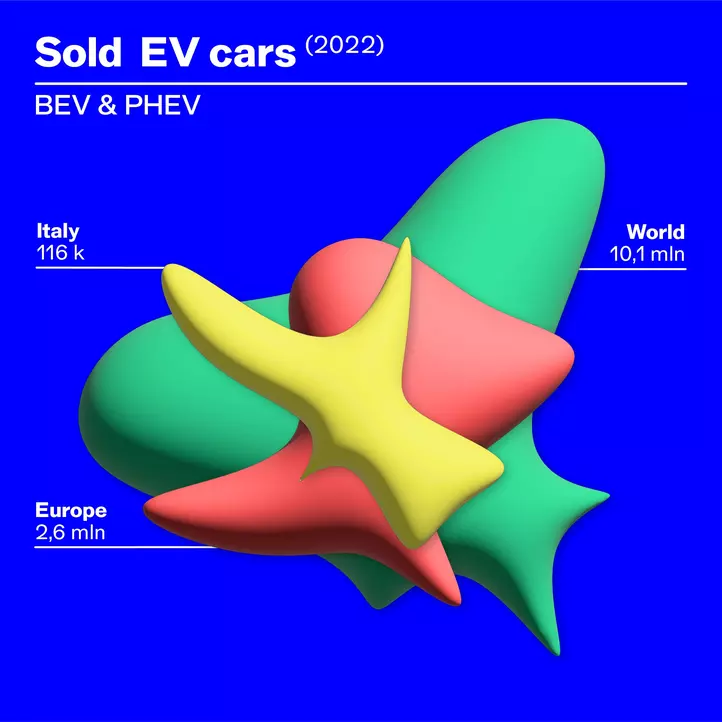

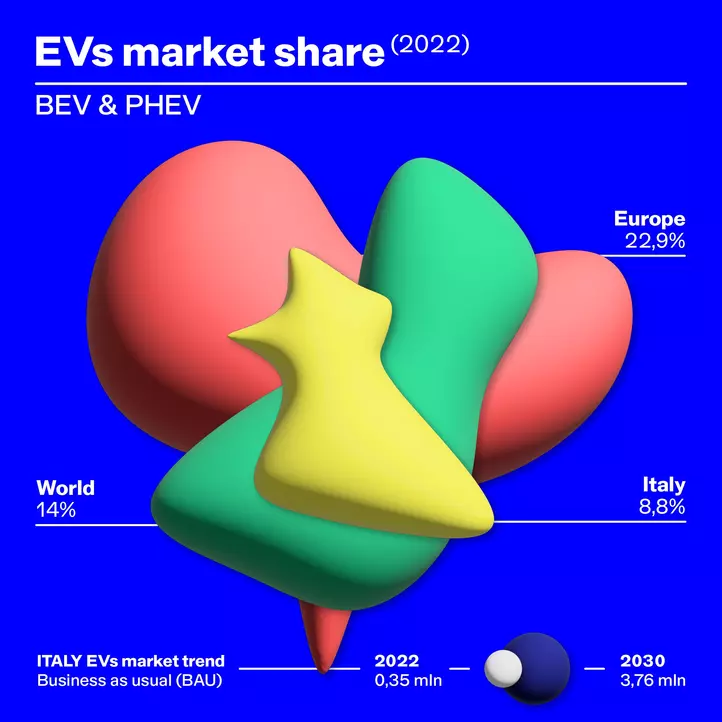

Italy is slowing down and risks falling behind in the decarbonisation of transport, according to the Smart Mobility Report 2023 by Milan’s Polytechnic University, which warns: without accelerating, the transition targets will not be met. The big goal is 6.6 million electric cars on the road in 2030, PNIEC target set by the government, but, if current policies do not change, projections predict only 3.8 million by then. With 350,000 EV cars on the road today and a 15% drop in registrations between 2021 and 2022, even more needs to be done, including on the regulatory and charging infrastructure level.

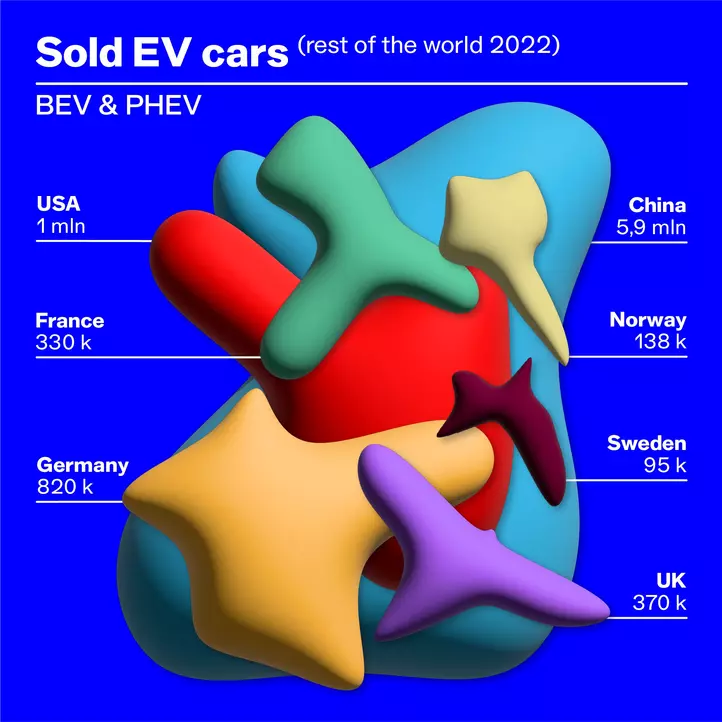

This is the alert raised by the experts from the Energy & Strategy team and the Smart Mobility Observatory, authors of the study. And the comparison with the rest of the world leaves no alibi: BEV and PHEV make up 14% of the share sold in the global automotive industry (2022), while Italy dropped from 9.3% to 8.8% in 2022 (8.2%, June 2023). The European average is higher, 22.9% in 2022 (20.5%, June 2023) and the comparison with Germany (31%), the UK (23%) and France (22%) does not hold. The growth rate in China (+82%, for 5.9 million cars sold) is of a different nature.

Cars

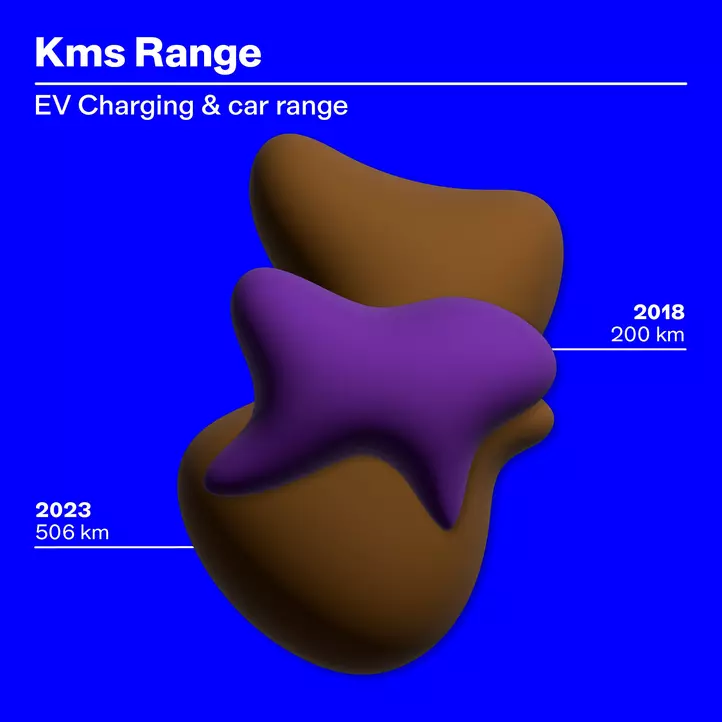

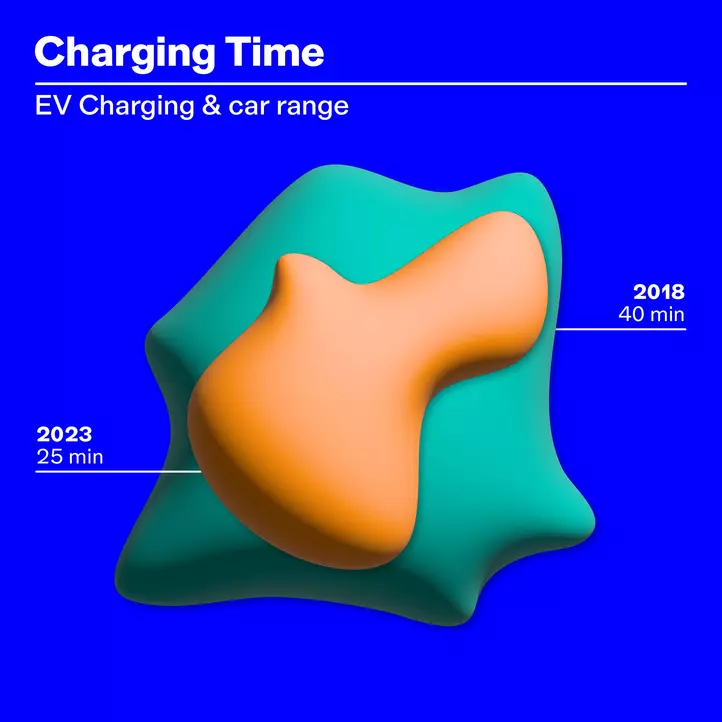

The scenario is full of chiaroscuro. The number of full electric passenger cars on the market has increased by 31%, recharging times have dropped by 35% in five years and the average range has exceeded 350 km. However, several problems persist in the sector such as the 5-10% price increase and the higher purchase cost (69-75%) compared to fossil fuel cars (35-58%), on the total cost of car ownership over 12 years (Smart Mobility Report research on the hypothetical usage behaviour of five user personas).

“The effort of the manufacturers exists, the dynamic we are seeing in the automotive industry is enormously greater than in the recent past, but for now the stage of development is still low and the cost of components high,” explains Professor Vittorio Chiesa, of the Energy & Strategy scientific committee. “The increase in raw materials may have weighed on production levels that are still too small in scale, as the European market is 2.6 million vehicles, distributed among several manufacturers. In determining purchasing dynamics, therefore, the consumer's sensitivity to environmental issues, his or her economic availability and the effect of incentives, which unfortunately in Italy is limited but elsewhere is conspicuous, still prevail.”

The growth of EV cars registered in 2022 (from 4.3 to 9.3 per cent) also depended on the Ecobonus incentive, used by 80 per cent of buyers. Nonetheless, the measure is considered not very effective: “The combination of the low expenditure ceiling, the limited expected contribution and the large price gap between BEVs and ICEVs on the market has resulted in a slower than desired spread of EVs,” the report states.

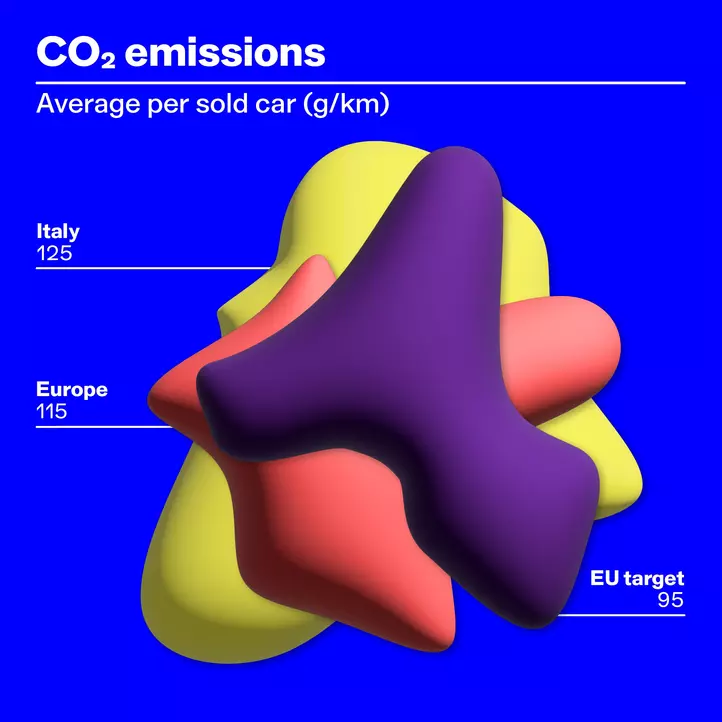

The incentive is also not very courageous from the point of view of emissions, as it covers the purchase of polluting cars up to 135 gCO₂/km, while the average emission level of new vehicles stipulated by the relevant European regulation (2023/851) is already 95 gCO₂/km until 2024, with a gradual reduction in view of total decarbonisation in 2035.

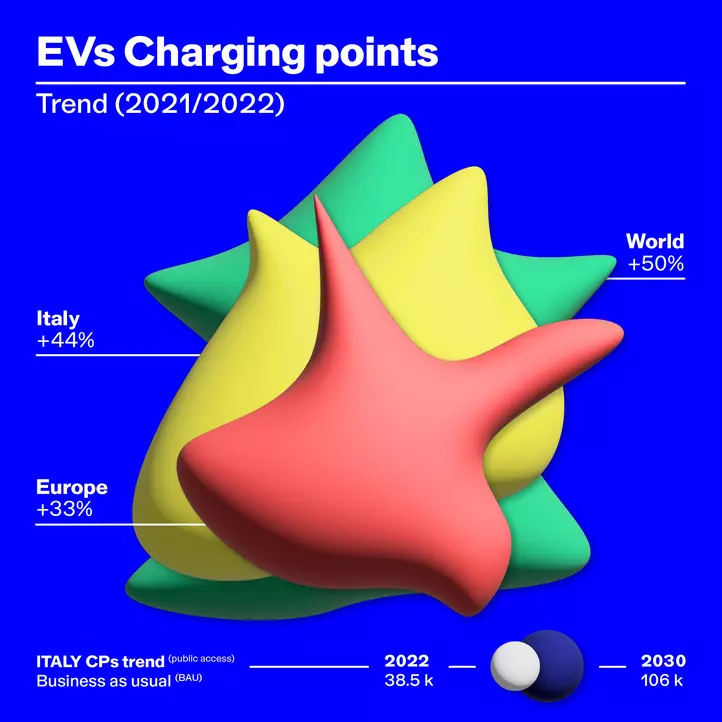

Charging points

The infrastructure is growing in an interesting way: there are 510,000 public charging points in Europe in the first six months of 2023 and in Italy 42,700, with a normal charge (below 22 kW) share of 85-86% and fast charge growth of 63% and 57%. With an average charging station power of 80 kW and a majority of cars enabled for 75 kW DC charging, this appears to be the most promising solution to improve the user experience in charging times.

The most striking fact is the growth (+170% in 2022) of residential charging points in Italy, 370,000, which is in contrast to the registration rate and “drugged by the Superbonus incentive, which could produce a return to lower growth rates,” says Chiesa. In this scenario, it seems consistent that 90 per cent of electric car owners do more than half of their charging at home and only 15 per cent via public infrastructure. Insufficient territorial coverage (36%), high recharging price (33%) and too long recharging times (24%) are the main reasons hindering the use of stations.

“The deployment of public infrastructure suffers from regulatory confusion due to the overlapping of three measures,” explains Chiesa. “The European AFIR regulation, which stipulates the presence of charging points on the motorway network (TEN-T corridors), the Italian budget law, which required concessionaires to carry out the installations, and the resolution of the Transport Regulatory Authority, which defines the outline of the calls for tenders. The NRRP tenders also had a strong response from operators on urban centres, but the part relating to highways and trunk roads remains completely lacking. This is the most significant shortcoming, which contributes to the ‘range anxiety’ of the electric vehicle user.”

The energy system

The effective transition to renewables will also have an impact on the effective decarbonisation of mobility. The Italian energy system as a whole will have to increase from 20.1 per cent in August 2023 to 40.5 per cent in 2030, in line with the EU target. The electricity sector has the highest penetration of renewables and the new PNIEC has raised the target for consumption from these sources to 65% for 2030 (from the previous 55%) to take into account the ‘Fit for 55’ package.

“The whole construct stands if the electricity is produced from renewable sources so as to ensure the sustainability effect of the transport means,” Chiesa warns. “As we know, there can be difficulties of various kinds, such as stakeholders in the energy sector or finance who do not believe us or international crises that bring fossil fuels back into the picture, as happened recently with coal in Germany. It is clear that the transition process has a significant and challenging trajectory between now and 2030.”