The infrastructure sector will be pivotal in the global post-pandemic recovery, which is expected to be transformative and more “ESG compliant”, in order to reach Net Zero emissions by 2050 as stated by the United Nations. Gaining trust and commitment from investors is crucial, bearing in mind the need to spot new trends in Infrastructures, securing at same time environmental and financial long-term returns.

Founded in 2016, the Global Listed Infrastructure Organization (GLIO) represents and promotes the interests of the listed infrastructure companies and institutional investors in the asset class. As a general principle, the GLIO Index captures those firms engaged in activities that are 'mission critical' to the day-to-day functioning of society and the global economy: regulated utilities, transportation infrastructure, communications infrastructure and energy transportation infrastructure companies.

Together with GRESB, the environment, social and governance (ESG) assessment and benchmark specialist, and Global Property Research (GPR), GLIO also launched the world’s first specialist ESG-filtered listed infrastructure index, about one year ago. We had a talk about these issues with Fraser Hughes*, founder and chief executive at GLIO, the representative body for the 3 trillion dollars market capitalization listed infrastructure asset class.

Mr. Hughes, while tech, pharma, financial players and even crypto make headlines and seem to attract a good portion of capital, what does it mean investing in Infrastructure, in the context of today's market?

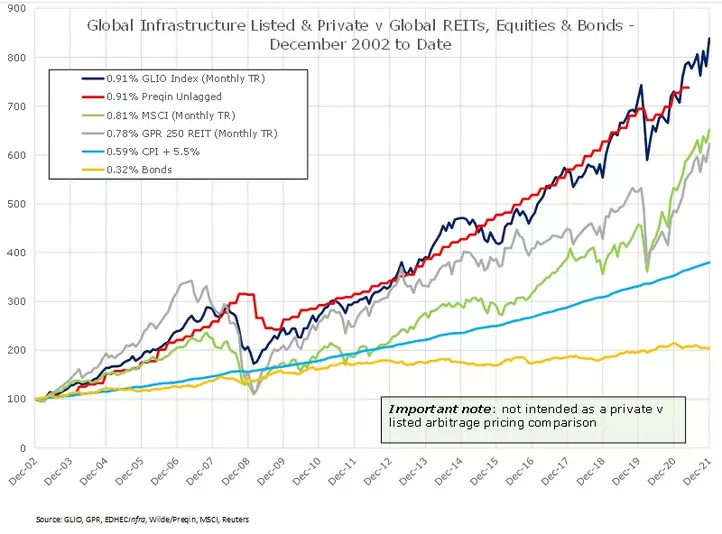

“Investing in listed infrastructure offers investors many opportunities. Looking back the asset class has generated impressive long-term annual returns coupled with lower volatility compared against the global equity market. For example, the GLIO Index (in Euro terms) returned +9.8% per annum versus +9% per annum for global equities over the last 15 years. Moreover, listed infrastructure achieved these higher annual returns with on average 300 basis points less volatility per annum.

Looking forward, the 3 trillion dollar listed infrastructure sector represented by the GLIO Index will offer investors many opportunities. For example, with approximately 50% of utilities (1.5 trillion dollar) making up the GLIO Index, accessing regulated utility companies who will be central to the global climate transition can be done through the index.

It should be noted that general equity indices are only marginally exposed to infrastructure related companies. Given the essential role of infrastructure in the global economy, investors would be remiss to ignore the infrastructure asset class.”

What is the role of infrastructure shares today, in a diversified investor's portfolio?

“Top down, the essential services provided by listed infrastructure companies – utilities and renewables, energy infrastructure and storage, communications and transportation form the backbone of todays and the global economy of tomorrow.

However, listed infrastructure only makes up 5 percent of the global equity market. We’d argue that to participate in essential infrastructure developments over the course of the next 30 years, investors should look at a separate dedicated allocation to infrastructure.

This approach would allow investors to take advantage of the changes in how the global economy generates, stores and distributes energy, renewables and electrification, how we communicate both in business and personally, and how the global economy moves a growing population, plus its goods and services.

Listed infrastructure has many benefits including exposure to essential services, strong relative returns in periods of inflation, lower volatility versus equities, stable cash flows, exposure to long-lived assets, high barriers to entry, and inelastic demand. In addition, a key advantage to investing in infrastructure through listed companies in the GLIO Index is the liquidity (the ability to easily buy, sell or adjust exposure) of public markets while tracking underlying infrastructure returns.”

(see Figure 1 - Listed infrastructure tracks private infrastructure and outperforms equities)

Infrastructure has been seen for a long time as a static and traditional sector, hard to innovate and "hard to abate" in regard to emissions. Today there is much debate about digitalisation and getting zero emissions with infrastructure, instead.

So, what has changed? And what's the role of finance, in promoting sustainability and innovation criteria in such a sector?

“Listed infrastructure companies are positioned to benefit from a series of long-term investment themes. First, infrastructure investment is more critical than ever going forward with more than 100 trillion required globally to modernize existing infrastructure and develop the infrastructure of the future. Investment is essential in both developed and emerging economies.

Second, decarbonization is driving a global energy transition on a scale never seen before and to hit our net zero targets this must accelerate multiple times over the next decade. Listed infrastructure utility companies like GLIO member Nextera Energy, the world’s largest generator of wind and solar power are well placed to take advantage of future developments.

Third, every industry is going through technological change, and digital transformation is central to this. Tower infrastructure companies like GLIO members American Tower, Crown Castle and SBA Communications own and manage well over 250 billion dollars of essential assets and will support this growth for years to come.

And last, but not least, the movement of goods and services is essential to the global economy. For example, freight rail and marine ports transport much of the global supply chain from business to business, and business to customer.

Investor pressure has placed ESG issues very firmly on the map. Put simply, if infrastructure companies do not embrace the change that will lead them on a path to net zero, for example, they will be left in the cold and potentially starved of capital. It should be noted that many companies in the GLIO Index already have net-zero commitments in place, and a number have committed to accelerating, or bringing forward their net-zero target date”.

What comes first: investing in electric (and autonomous) vehicles or creating Infrastructures to make them run?

“The bigger picture is that this should happen in parallel but the risks are short term lead/lags and uneven deployment. For example, in a recent EU special report they state that the infrastructure for charging cars is too sparse across the EU. They state that more charging stations have come online, but even deployment still makes travel across the EU complicated. The report also states that the EU is still way off its Green Deal target of one million charging points by 2025.”

Investors need to spot the new profitable trends: which are the best performing Infrastructure sectors, today? And which are the most prominent innovations, leading the way for the next generation of infrastructures?

“We can detail three sectors, starting with communications. Data needs are growing exponentially and the pandemic has accelerated existing data reliance. The focus is on increased speed coupled with the networks’ ability to handle more devices with increased bandwidth. By 2025 it is estimated that nearly 3 billion people globally will have 5G subscriptions. Tower infrastructure and data center companies are ideally positioned here.

Then, electrification. Renewables are rapidly disrupting traditional energy sources and are on track to represent the majority of the world’s global power generation by 2050. It is estimated that clean sources of energy will exceed 60% of the global generation mix in 2050, up from just 9% of the global power generation mix currently. Those utility companies that decommission old coal plants and increase renewables will benefit.

Thirdly, transportation. We’ve mentioned opportunities for freight rail and marine ports, and traffic congestion presents opportunities for toll-road operators like GLIO member Transurban and Atlantia. US ‘Managing lanes’ could be a good example of a solution here, where drivers can periodically move from a free highway lane into a toll road adjacent to the highway, and the amount of the toll paid depends on congestion levels.

How did the pandemic affect the Infrastructure financial assets? And how is this sector recovering?

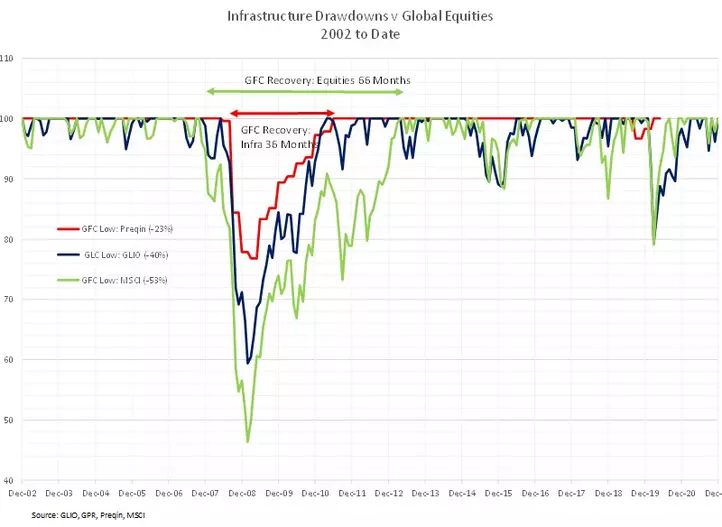

Figure.2 – listed infrastructure fell 20 percent but recovered quickly

“Figure 2 highlights the drawdowns of listed infrastructure (blue) versus global equities (green). Both listzed infrastructure and equities lost 20 percent of their value when the pandemic hit in early 2020 but recovered this loss quickly over the following 12 month period. In fact, since the low point in March 2020, the GLIO Index has gained 39 percent”.

How the subsidies from the American Infrastructure plan and European Recovery Fund might ultimately affect this market?

“Governments around the world have either proposed or enacted infrastructure investment programs approaching 3 trillion dollars, seeking to drive a sustainable economic recovery and reduce carbon emissions. For example, in the U.S. (a 1 trillion dollars bipartisan infrastructure bill was approved in november, Editor's note) there are several potential benefits from proposed spending: direct benefits for renewable energy developers and electric utilities, primarily through tax incentives; potential for new revenue opportunities for cell tower and data center companies due to a larger addressable market for wireless carriers; added boost to economic growth prospects, potentially supporting many segments of listed infrastructure (particularly railways, marine ports, toll roads and airports).

It is worth recapping some of the major infrastructure spending programs supporting growth around the world, set to strengthen an already attractive environment for infrastructure businesses. United Kingdom budgeted 800 billion dollars infrastructure spending over the next five years, the highest sustained levels in more than 40 years. The 865 billion dollars Next Generation EU recovery fund includes a large green infrastructure component. In Japan: a 400 billion dollars in green and digital infrastructure investment is part of a 710 billion economic stimulus package. Australia provides 80 billion dollars in land transport improvements over the next decade**."

Which parameters do you take into account, when selecting and evaluating companies for GLIO index?

“There are three main criteria when selecting a company’s eligibility for the GLIO Index and the GLIO/GRESB ESG Index. 75% of EBITDA must be derived from relevant infrastructure which include: regulated utilities and renewables, energy transportation and storage, transportation and communications infrastructure; minimum free float (tradable) market capitalization size which as at December 31, 2021 was >$500m; minimum annual liquidity”.

How do you measure ESG ratings, and which parameters are considered, in regard to GLIO / GRESB index, instead?

“The GLIO/GRESB ESG Index includes all companies from the parent index (there are no exclusions) but companies that score well for ESG public disclosure are weighted up (or rewarded) and those that score poorly/average are weighted down. The GRESB Public Disclosure evaluation is based on a set of indicators which include disclosures of: sustainability governance and implementation, operational performance data and stakeholder engagement practices”.

What's the real impact that ESG concerns are having on the Infrastructure sector?

“There are a couple of ways to view the current situation with ESG and listed infrastructure companies. In an article covered in Issue 9 of the GLIO Journal we argue that the strict ESG thresholds used by many generalist index providers and investment managers are ruling out investment in the very companies that will be central to the energy transition. For example, many utility companies are retiring coal generation at an accelerated rate but remain above the maximum 5 percent from coal which is used by index providers. This potentially starves next generation green utility companies of capital now, when the capital could be used to move forward change.

What's your balance one year after the launch of GLIO / GRESB index?

“We have historical data now for over three years for the GLIO/GRESB ESG Index. The index has been received well by the specialist infrastructure investment community as it is the only ESG rating system that is specifically tailored for infrastructure assets. The index is also a great point of engagement for the investment community and the listed companies under an industry organisation umbrella – GLIO”.

ESG ratings often do not match each other, as this evaluation is not based on financial datas, no common standard measurement is adopted. Is there a real matter of trust, when investing in ESG assets? How to approach this issue, when investing?

“We believe moving forward that more standardization is needed and this could be a role for GLIO in the future for infrastructure ratings. It is worth noting again that the GLIO/GRESB assessment is the only rating system tailored specifically for infrastructure assets and we believe this to be the most accurate and reflective of the infrastructure market. However, engagement between companies and investors is the real key to building trust, monitoring progress and actively pushing change”.

So, how to detect greenwashing or social washing cases in such a sector? How to evaluate the impact of ESG investments?

“GLIO held a virtual panel discussion in December 2021 with investor members from First Sentier Investors, BlackRock and ATLAS Infrastructure. The panel agreed that the pathway to Net Zero is front and center of mind for infrastructure investors, and without infrastructure investment net zero is just a ‘tagline’ as the 3 largest producers of carbon emissions are the power generation, transportation and industrial sectors. The investors accepted that engagement with companies remains key to achieving a clear picture of their ESG progress, and more importantly to drive future change. It is also this engagement which will help identify gaps between ESG rhetoric and action which the panel admitted still exists”.

Atlantia has performed well on many ESG indexes recently: which are the strengths and future opportunities for this holding, according to you?

“While the pandemic has hit global travel, transportation remains critical to the global economy and Atlantia’s position as one of the main European players in this space will stand it in good stead for the future - as and when the situation normalizes. The accelerated adoption of electric vehicles and smarter urban transport networks will present opportunities for companies like Atlantia and providing Atlantia’s commitments and targets along the pathway to low-carbon are met, the company will benefit. Progress on ESG themes will resonate with investors and the company’s latest score of 72/100 in the GLIO/GRESB ESG Index is a good example of this, but as a caveat – the quality of a company’s public disclosure remains only part of the story.

Further engagement with dedicated infrastructure investors under the GLIO umbrella will be helpful and GLIO membership would be welcomed by all”.