Which airports are the busiest in the world? What is the status of air travel recovery after the 2020 pandemic? How are passenger and cargo flows changing globally? These and many other questions are answered by data published this year by Airports Council International (ACI) World, the largest trade association with 757 members in 191 countries worldwide.

The database, based on more than 2,700 airports, allows global traffic to be estimated at 8.7 billion passengers, or 94.2 per cent compared to pre-pandemic levels with a growth of 30.5 per cent over 2022. The movement of people sails towards full recovery in 2024, with 9.7 billion, above 2019 levels (106%) for the first time since the pandemic, according to forecasts.

The market trends

“Global air travel in 2023 was mainly fuelled by the international segment, driven by many factors. These included the benefits from re-openings in China and an increasing inclination to travel, despite macroeconomic conditions,” noted Luis Felipe de Oliveira, outgoing ACI World CEO who will be replaced by Justin Erbacci as of 1 September.

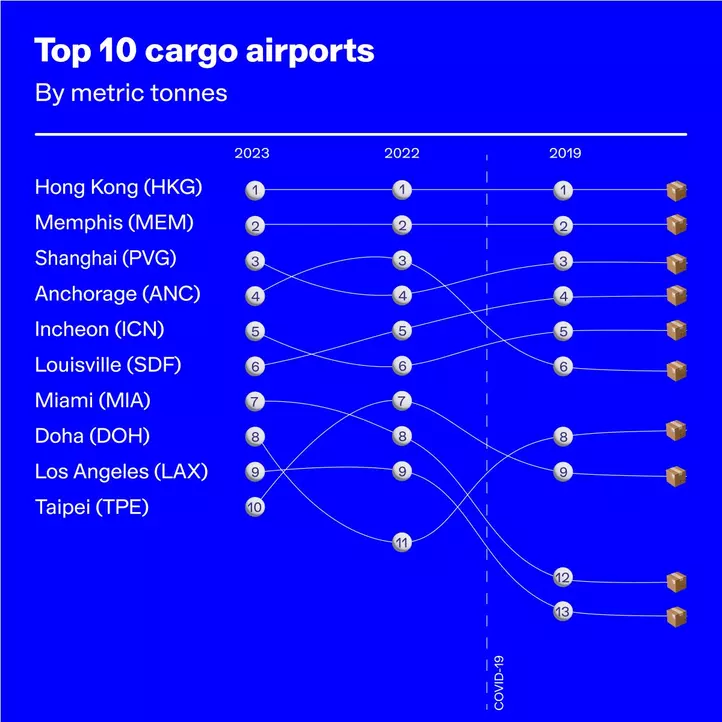

For the cargo segment, on the other hand, its numbers are still in the negative. At close 115 million tonnes, freight transport decreased in 2023 year-on-year (-1.8%) and compared to 2019 (-4.9%). The decline can be attributed to continuing geopolitical tensions and disruptions in global supply chains and trade. After some ups and downs, the final surpassing of pre-pandemic levels is expected one year later than for passenger flights, i.e. in 2025, with 130.3 million tonnes of cargo transiting in our skies.

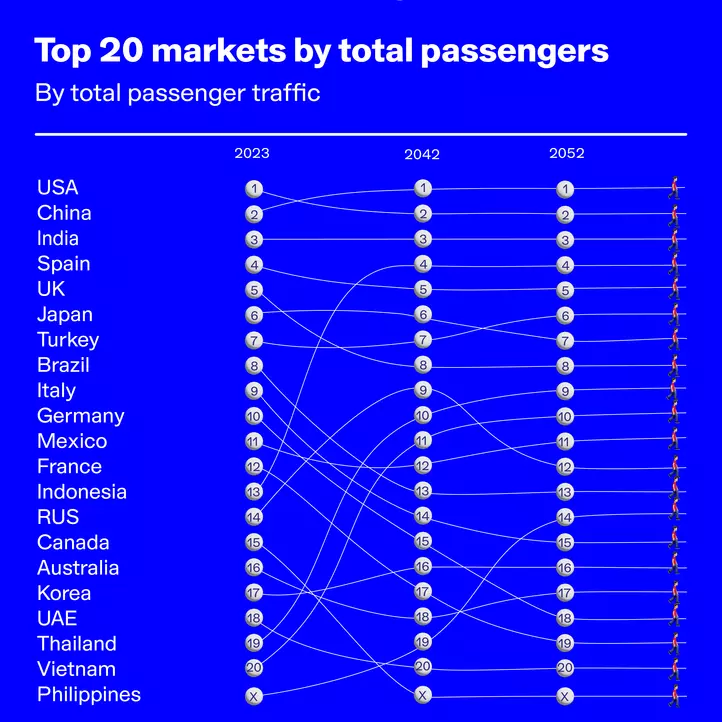

Macroeconomic factors, such as high global inflation, slowing global GDP and pessimistic confidence levels in the economy, as well as geopolitical tensions, pose significant risks and uncertainties on the outlook for the coming years. Before the pandemic, for example, the expected passenger volume for 2023 was 10.5 billion. ACI World, however, suggests a doubling of total passengers by 2042 and growth by 2.5 times by 2052.

“In the long term, the market dynamic for passengers is expected to shift from advanced to emerging and developing economies as they experience significant urbanisation and demographic increases, often combined with rapid economic growth and with a favourable impact on disposable income and willingness to travel,” de Oliveira explains.

The rankings

The numbers compiled by ACI World show that the Asia-Pacific and Middle East hubs are strengthening and continued to emerge in 2023, while some confirmations remain: the American leadership and the unrelenting strength of Istanbul and New Delhi. In particular:

- Atlanta's leadership as the world's busiest airport (104.6 million passengers) continues, although still below 2019 levels (-5.3%). It is one of five US airports in the top 10, along with Dallas, Denver, Los Angeles and Chicago.

Georgia's capital is only the seventh largest metropolitan area in the United States and not even among the top 40 in the world, but the airport has held the world record for passenger traffic continuously since 1998 except for 2020. It is a hub for domestic and international travel (150 destinations) thanks to its strategic location within easy reach of New York, Dallas, Houston and Chicago. It is well connected to major highways and railways and is only 16 kilometres from the city centre. It is also the hub of Delta Airlines and offers state-of-the-art facilities; government and businesses have always supported investment in the airport since 1920.

- Dubai climbs to second place for the first time, surpassing Dallas and is the first port of call in terms of international passenger transit (86.9 million total).

Together with London (Heathrow) and Istanbul, it is one of three airports in both rankings. It has a capacity of 90 million passengers a year, over three terminals for 262 reachable destinations and is the reference hub for Emirates Airline. However, the airport will be closed when the expansion of the United Arab Emirates’ new mega airport, Al-Maktoum, is completed.

- Tokyo Haneda makes the biggest leap, from 16th place to fifth, between 2022 and 2023 (+55.1%), although it is still in deficit compared to 2019 (-7.9%). In the international segment, it is Incheon Airport in Korea that makes the greatest progress, tripling its passengers (55.7 million) and moving from 32nd to fifth place.

- Hong Kong and Memphis retain the top two positions for cargo, while Shanghai overtakes Anchorage. Seemingly far from the busiest routes, the airport in Alaska remains the one with the largest increase over the pre-Covid period (+20.7%).

Located halfway between Hong Kong and the contiguous United States, it is a perfect port of call for cargo transshipment, crew changes and refuelling. Leaving with less petrol, in fact, allows more goods to be transported, plus the price of fuel is lower thanks to tax breaks applied there. These advantages mean that many carriers departing from China have chosen Anchorage as a stopover, instead of Shanghai or Hong Kong itself, delivering Asian goods required in the US more quickly in the Covid era. - The ratio of international to domestic (40-60%) of total flights has almost returned to pre-pandemic levels (42-48% in 2019). The restrictions had led to a collapse in international flights, which dropped by 26-74% in 2020.

The comment

“The rankings underline the crucial role of these transport hubs in global connectivity, trade and economic development. Airports continue to prove their resilience and adaptability amidst the evolving challenges of global transport,” de Olivera explained. “Responsible investment in existing and new infrastructure remains crucial to ensure that capacity growth can be sustainably addressed to maximise the social and economic benefits of aviation.”

An earlier forecast by ACI World estimated the investment needed to expand and improve airport infrastructure worldwide between now and 2050 at USD 2,400 million.